Design Your Own Global Diversified Portfolio in German Mixed-Use Properties

Discover Profitable Investment Opportunities in German Real Estate

Invest in a diversified portfolio of high-performing assets across multiple sectors and geographies. Connect with us to learn more about how you can benefit from our unique experience in identifying strategic investment opportunities.

Design Your Own Global Diversified Portfolio in German Mixed-Use Properties

Discover Profitable Investment Opportunities in German Real Estate

Invest in a diversified portfolio of high-performing assets across multiple sectors and geographies. Connect with us to learn more about how you can benefit from our unique experience in identifying strategic investment opportunities.

LOCATION

Germany

Macro Highlights: The Strength of Germany’s Economy

Germany is known for its robust and stable economy, making it an attractive destination for real estate investment. Here are some key macroeconomic factors:

Economic Stability: Germany boasts the largest economy in Europe and the Third-largest in the world. Its GDP growth is consistent, supported by a diversified industrial base.

Political Stability: The country’s stable political environment and transparent legal system provide a secure foundation for long-term investments.

Low Unemployment Rates: With one of the lowest unemployment rates in Europe, Germany has a strong and reliable workforce.

Strong Industrial Base: Home to leading global industries such as automotive, engineering, and manufacturing, Germany’s economy is both diverse and resilient.

Favorable Financing Conditions: low-interest rates and favourable financing terms make it easier for investors to achieve high returns.

Micro Highlights: The Potential of Dortmund and Duisburg

Dortmund: A Thriving Economic Hub

Dortmund, located in the North Rhine-Westphalia region, is one of Germany’s key secondary cities. It offers numerous opportunities for investors:

Population and Workforce: With a population of around 600,000, Dortmund has a strong and growing workforce.

Economic Activities: The city is a hub for finance, technology, and education, hosting numerous multinational companies and innovative startups.

Connectivity: Dortmund has excellent transportation infrastructure, including extensive road, rail, and air connections, making it easily accessible.

Cultural and Social Attractions: A rich cultural scene with museums, theatres, and sports facilities enhances its appeal as a place to live and work.

Duisburg: The Logistics and Commerce Powerhouse

Duisburg, also in North Rhine-Westphalia, is renowned for its strategic importance in logistics and commerce:

Largest Inland Port: Duisburg is home to the largest inland port in Europe, serving as a critical logistics hub for international trade.

Strategic Location: Its proximity to major cities like Düsseldorf and Cologne enhances its connectivity and commercial appeal.

Diverse Economy: Duisburg’s economy is bolstered by logistics, manufacturing, and services, providing a stable and diverse economic base.

Population and Workforce: With a population of approximately 500,000, Duisburg has a robust labour market supporting various industries.

Investing in Germany’s real estate market, particularly in cities like Dortmund and Duisburg, means tapping into regions with strong economic foundations, excellent connectivity, and a diverse mix of industries. These factors contribute to stable rental incomes and long-term capital appreciation for real estate investments.

Disclaimer: The information provided in this email/post/document/page has been supplied by Encore Property Managers. While we strive for accuracy, Wealth Migrate cannot guarantee the completeness or reliability of this information. We encourage you to conduct your own research and due diligence before making any investment decisions. The views expressed are those of Encore Property Managers and may not reflect those of Wealth Migrate.

DEAL HIGHLIGHTS

Key Highlights of the Deal

Prime Real Estate Investment Opportunity

Project ABBA - Encore offers investors the chance to own a stake in three strategically located mixed-use properties in the vibrant cities of Dortmund and Duisburg, Germany. Here are the key highlights:

Prime Locations: The properties are situated in city center areas with excellent connectivity, ensuring high demand from both residential and commercial tenants.

Diverse Tenant Mix: Featuring medical offices, educational institutions, and retail spaces, the tenant diversity ensures multiple and stable income streams.

High Occupancy Rates: The properties maintain an impressive occupancy rate of over 85%, highlighting their desirability and the strength of the local rental market.

CPI-Based Rental Increases: Leases tied to the Consumer Price Index (CPI) provide a natural hedge against inflation, ensuring rental income growth over time.

Experienced Sponsor: Encore Properties, led by Peter Katz, brings over 20 years of expertise in managing German real estate, ensuring professional and efficient asset management.

Thorough Due Diligence: Our partner, Caleo, conducts comprehensive due diligence, covering financial, structural, legal, and environmental aspects, ensuring the safety and profitability of your investment.

Environmental and Social Governance (ESG) Compliance: The properties have strong ESG metrics, aligning with modern investment standards and enhancing their long-term value.

Projected Opportunity in Numbers

Investing in Project ABBA - Encore offers compelling financial prospects. Here are the projected numbers:

Base Case IRR: 14.5%, offering substantial returns on investment.

Equity Multiple: Expected to achieve between 1.5x and 1.7x over the investment period, reflecting the potential for significant value appreciation.

Cash-on-Cash Return: Attractive returns, driven by stable rental income and strategic asset management.

Occupancy Rate: Over 94%, with a strong track record of maintaining low vacancies.

Rental Income Growth: Benefiting from CPI-based rental increases and under-rented tenants, ensuring steady growth in rental income.

Investment Term: Estimated 5-year term, providing a balanced timeframe for income generation and capital growth.

Disclaimer: The information provided in this email/post/document/page has been supplied by Encore Property Managers. While we strive for accuracy, Wealth Migrate cannot guarantee the completeness or reliability of this information. We encourage you to conduct your own research and due diligence before making any investment decisions. The views expressed are those of Encore Property Managers and may not reflect those of Wealth Migrate.

DEAL PARTNER

Encore Properties

We are proud to partner with Encore Properties, a leading expert in the German real estate market. Led by Peter Katz, Encore Properties brings extensive experience and a proven track record in managing high-value real estate assets.

About Encore Properties

Encore Properties is renowned for its strategic approach to real estate investment and management. With a focus on risk-averse strategies and stable returns, Encore Properties has successfully managed a diverse portfolio of assets across Germany.

Key Highlights of Encore Properties

Experienced Leadership: Peter Katz, Managing Partner, has over 20 years of experience in the German real estate market. His expertise ensures that all investments are managed with the highest level of professionalism and insight.

Proven Track Record: Encore Properties has successfully managed assets worth approximately €90 million, demonstrating their capability and reliability in delivering consistent returns to investors.

Risk-Averse Investment Strategy: By focusing on low-risk investments, Encore Properties ensures stable income and capital growth for their investors.

Comprehensive Due Diligence: Each investment is subjected to thorough due diligence, covering financial, structural, legal, and environmental aspects to ensure safety and profitability.

Strong Tenant Relationships: Encore Properties maintains excellent relationships with a diverse range of tenants, ensuring high occupancy rates and stable rental income.

Commitment to ESG

Encore Properties is committed to Environmental, Social, and Governance (ESG) principles, ensuring that all investments are sustainable and socially responsible. This commitment enhances the long-term value and appeal of the properties managed by Encore Properties.

Disclaimer: The information provided in this email/post/document/page has been supplied by Encore Property Managers. While we strive for accuracy, Wealth Migrate cannot guarantee the completeness or reliability of this information. We encourage you to conduct your own research and due diligence before making any investment decisions. The views expressed are those of Encore Property Managers and may not reflect those of Wealth Migrate.

Due Diligence

Expert Oversight by Caleo Private Equity

At Wealth Migrate, the safety and profitability of your investment are our top priorities. That’s why we partner with Caleo Private Equity, whose experienced team conducts comprehensive due diligence to ensure every aspect of our investment opportunities is thoroughly vetted.

Meet the Caleo Team:

Glen Scorgie, CA (SA)

Co-CEO

Glen has over 20 years of experience in investing and fundraising globally. He began his career as a dealmaker and portfolio manager at Rand Merchant Bank (RMB), where he managed the US high-yield bond portfolio, investing over $1 billion of capital in over 150 US and European corporates. He subsequently co-founded RMB’s Opportunities in Global Real Estate portfolio and went on to co-found the RMB Westport Real Estate Development Fund; the largest sub-Saharan Africa real estate private equity fund at the time. Prior to joining Caleo Private Equity, Glen was Chief Investment Officer and a founding member of Gateway Delta Development Holdings.

Education: BCom Accounting Hons (UNISA); Bachelor’s Degree in Accounting (Wits)

Selwyn Blieden, PhD CFA

Co-CEO

Selwyn has over 20 years of experience in consulting and banking, locally and abroad. He began his career at McKinsey & Co. in Johannesburg, undertaking projects across Africa. He subsequently co-founded and managed RMB’s Opportunities in Global Real Estate portfolio and later co-founded the RMB Westport Real Estate Development Fund, the largest sub-Saharan Africa real estate private equity fund at the time. Prior to joining Caleo Private Equity, Selwyn led Absa’s commercial property finance business in Africa as a Principal at the Absa Group. He currently serves on the Board of Trustees of the African Leadership Academy.

Education: PhD Mathematics (Cambridge); BA Hons in Mathematics and BA in Mathematics and Economics (Wits)

Key Elements of Our Due Diligence Process

Financial Analysis: Detailed examination of the financial health of the properties.

Structural and Physical Evaluation: Comprehensive inspections and environmental assessments.

Legal Compliance: Ensuring clear ownership and lease agreement stability.

Market Analysis: Studying local market conditions and competitive landscapes.

Risk Management: Assessing tenant creditworthiness and insurance coverage.

Why Our Due Diligence Matters

Investment Security: Minimizes risks, ensuring your investment is secure.

Transparency: Provides detailed and transparent reports.

1 Column

Peace of Mind: Allows you to invest with confidence.

ASSET CLASS / PROPERTY DETAILS

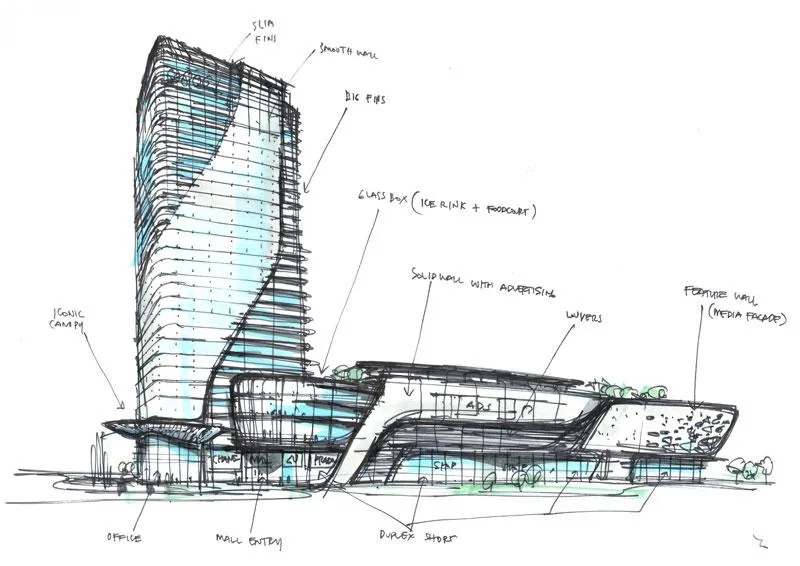

Mixed-Use Properties: A Strategic Investment Choice

Our investment opportunity centres around mixed-use properties, combining residential, commercial, and retail spaces within a single development. This asset class offers numerous advantages:

Diversified Income Streams: Mixed-use properties ensure multiple sources of income, reducing reliance on any single tenant or market segment.

Risk Mitigation: The blend of different property types helps to spread risk, making the investment more resilient to market fluctuations.

Community Appeal: These properties create vibrant, lovable communities that are attractive to residents and businesses alike.

Property Details

We are thrilled to present three strategically located mixed-use properties in the North Rhine-Westphalia region, specifically in Dortmund and Duisburg. Here are the key highlights:

Dortmund Properties

Location: Prime city center areas with excellent connectivity and high demand.

Tenant Mix: Medical offices, educational institutions, and retail spaces ensure stable and reliable Rental income.

Occupancy Rate: Over 85% occupancy, with potential for further growth.

CPI-Based Rental Increases: Leases tied to the Consumer Price Index provide a natural hedge against inflation.

Duisburg Property

Location: Close proximity to the largest inland port in Europe, enhancing its commercial appeal.

Tenant Mix: Medical offices and commercial spaces attract a diverse range of tenants.

Occupancy Rate: Consistently high occupancy rates, supported by the strategic location.

Logistics Hub: Strategic importance in logistics and commerce, attracting multinational corporations.

Investment Potential

Base Case IRR: 14.5%, offering substantial returns on investment.

Equity Multiple: Expected to achieve between 1.5x and 1.7x over the investment period.

Cash-on-Cash Return: Attractive returns driven by stable rental income and strategic asset management.

List of Tenants

Diverse and Reliable Tenant Mix

Our mixed-use properties in Dortmund and Duisburg are home to a variety of reputable and stable tenants. This diverse tenant base ensures multiple income streams and enhances the stability of rental income.

Top Tenants

Grone Bildungszentrum

Industry: Education

Description: Grone Bildungszentrum is part of the Grone-Schule Foundation, one of the largest private educational and personnel service providers in Germany. They offer a wide range of vocational training and continuing education programs, particularly in the fields of healthcare and social services. Grone has a strong presence with over 200 locations across Germany, providing essential training and qualification services to various sectors.

Augenarzt Zentrum GbR

Industry: Medical

Description: Augenarzt Zentrum GbR is a specialized medical clinic focused on ophthalmology. They provide comprehensive eye care services, including routine eye exams, treatments for eye diseases, and surgical procedures. Their expertise and commitment to quality care make them a trusted healthcare provider in the community.

Gemeinschaft

Industry: Medical

Description: Gemeinschaft is a collective of medical professionals offering various healthcare services. They focus on providing high-quality medical care across multiple specialties, ensuring comprehensive health solutions for their patients.

Santander Bank

Industry: Banking

Description: Santander Bank is a leading financial institution with a global presence. Known for its robust banking services, Santander provides a range of financial products including personal and business banking, loans, and investment services. Their presence as an anchor tenant adds significant prestige and stability to the property.

Heininger & Kalin

Industry: Medical

Description: Heininger & Kalin is a reputable medical practice offering specialized healthcare services. They are known for their patient-centric approach and high standards of medical care, making them a reliable tenant and healthcare provider in the region.

Disclaimer: The information provided in this email/post/document/page has been supplied by Encore Property Managers. While we strive for accuracy, Wealth Migrate cannot guarantee the completeness or reliability of this information. We encourage you to conduct your own research and due diligence before making any investment decisions. The views expressed are those of Encore Property Managers and may not reflect those of Wealth Migrate.

Investment Risk and Reward

Investment Risk and Rewards Outlined

This investment offers a balance of high returns and managed risks, making it a compelling opportunity in a thriving market.

Risk Management

Comprehensive Risk Management Strategies

Ensuring the safety and profitability of your investment is our top priority. We employ rigorous risk management strategies to mitigate potential risks and secure your returns. Our partner, Caleo, conducts thorough due diligence, including detailed financial, structural, legal, and environmental assessments, to ensure the soundness of each investment. The diverse tenant mix, including education, medical, and banking sectors, further spreads risk and ensures stable income streams. Additionally, leases tied to the Consumer Price Index (CPI) provide a natural hedge against inflation, ensuring steady rental income growth over time. Continuous oversight and regular updates keep investors informed and confident in the status of their investments.

Tenant Stability

Reliable and Reputable Tenants

The stability of our investment properties is reinforced by a robust and diverse tenant base. Our properties are home to reputable tenants such as Grone Bildungszentrum, an established educational institution offering vocational training; Augenarzt Zentrum GbR, a specialized medical clinic providing essential eye care services; and Santander Bank, a major financial institution with a global presence. This diverse mix ensures multiple income streams and reduces reliance on any single industry. The presence of such reliable tenants not only guarantees steady rental income but also enhances the overall value and appeal of the properties.

Property Specific Risks

Identifying and Mitigating Property Specific Risks

While investing in real estate, it’s crucial to consider property-specific risks. For our properties in Dortmund and Duisburg, these properties benefit from high occupancy rates and a diverse tenant mix, reducing the risk of income loss due to vacancies. The thorough due diligence process conducted by Caleo includes structural and environmental evaluations to address any physical risks. Additionally, the strategic locations of these properties in high-demand urban areas further mitigate market risks, ensuring the investment remains resilient against economic fluctuations.

Reward Potential

High Reward Potential

Investing in Project ABBA - Encore offers significant reward potential. With properties strategically located in the high-demand areas of Dortmund and Duisburg, investors can expect attractive returns. The base case Internal Rate of Return (IRR) is projected at 14.5%, with an expected equity multiple of 1.5x to 1.7x over the investment period. The combination of high occupancy rates, CPI-based rental increases, and professional asset management ensures steady cash flow and long-term capital appreciation. This investment not only promises strong financial returns but also benefits from the stability and growth of the German real estate market.

Disclaimer: The information provided in this email/post/document/page has been supplied by Encore Property Managers. While we strive for accuracy, Wealth Migrate cannot guarantee the completeness or reliability of this information. We encourage you to conduct your own research and due diligence before making any investment decisions. The views expressed are those of Encore Property Managers and may not reflect those of Wealth Migrate.

DEAL WEBINAR

Watch Our Deal Launch Webinar to Learn More

We are thrilled to invite you to our exclusive deal launch webinar for Project ABBA - Encore, taking place on the 25th of June at 18:00 UK. This webinar is a unique opportunity to gain in-depth insights into this exciting investment opportunity, meet the team behind the project, and get your questions answered by experts.

Why Attend?

Detailed Project Overview: Learn about the investment properties in Dortmund and Duisburg, including their strategic locations, tenant mix, and financial projections.

Meet the Experts: Hear directly from the leaders at Wealth Migrate and Encore Properties, who will provide insights into the due diligence process, risk management strategies, and the overall investment potential.

Live Q&A Session: Engage with our experts in a live Q&A session to get personalised answers to your investment queries.

Exclusive Insights: Gain exclusive insights into the macro and microeconomic factors driving the success of this investment.

Webinar Highlights:

Comprehensive Project Presentation: Detailed walk-through of the properties and the investment strategy.

Expert Panel Discussion: Insights from industry veterans on the current real estate market and future trends.

Interactive Q&A Session: Direct interaction with the project leaders and experts.

Webinar Details:

Date: 25th June 2024

Time: 6pm UK | 7pm SAST

Don't miss this chance to enhance your portfolio. Secure your spot now.

Judd Dunning

DWG Capital Partners

Judd Dunning

DWG Capital Partners

Frequently Asked Questions

Why should I invest in German real estate?

Germany offers a stable and robust economy, making it an attractive destination for real estate investments. With strong demand in key cities, investing in German real estate ensures stable returns and growth potential.What are mixed-use properties?

Mixed-use properties combine residential, commercial, and sometimes industrial spaces within a single development. This diversification provides multiple income streams and mitigates risks.How does the investment process work?

Our investment process is straightforward. Register on our platform, complete your KYC verification, fund your wallet, and choose your desired investment amount.What is the expected return on investment?

Our base case IRR is 14.5%, with an expected equity multiple of 1.5x to 1.7x over the investment period. These projections are based on thorough due diligence and strategic asset management.

How can I learn more about this investment opportunity?

Join our exclusive webinar on June 25th at 6PM UK TIME to learn more about this exciting investment opportunity. Register here.

Wealth Migrate

Our mission is to make quality alternative assets accessible to anyone, anywhere, from any amount. Investors and collaborate and crowdfund institutional real estate investments and alternative assets usually only available to the wealthiest 1% investors. We are set on reclaiming financial freedom, taking on an industry that has for far too long been closed to the majority. There is a fundamental need for change. It's more than a want, it's why we aspire to be better. Change only requires a few fearless individuals and we are work towards creating the future. We believe boldly moving forward is necessary to be an agent of positive change in the world.

Your information is safe and it belongs to you. | Copyright © 2024 Wealth Migrate. | All rights reserved.

DEAL PARTNER

Deal provider DWG Capital Partners

DWG Capital Partners is the sponsor of this investment opportunity, leveraging over 20 years of capital markets experience. They specialize in sale-leaseback transactions and have a proven track record of managing high-value properties and securing attractive financing. DWG Capital Partners focuses on strategic investments that align with investor interests, ensuring sustainable growth and robust returns.